Northrop Grumman Newsroom

Northrop Grumman Gifts James Webb Space Telescope Full-Scale Model to the Space Foundation

Northrop Grumman Completes Assembly of Manta Ray Uncrewed Underwater Vehicle

Northrop Grumman’s Integrated Battle Command System Demonstrates Another Successful LTAMDS and Patriot Live-Fire Integration

Northrop Grumman’s Ballistic Missile Target Successfully Launched for Aegis Weapon System Test

Northrop Grumman Underscores Partnerships in Norway

The Low-Risk Path for Never-Fail Missions

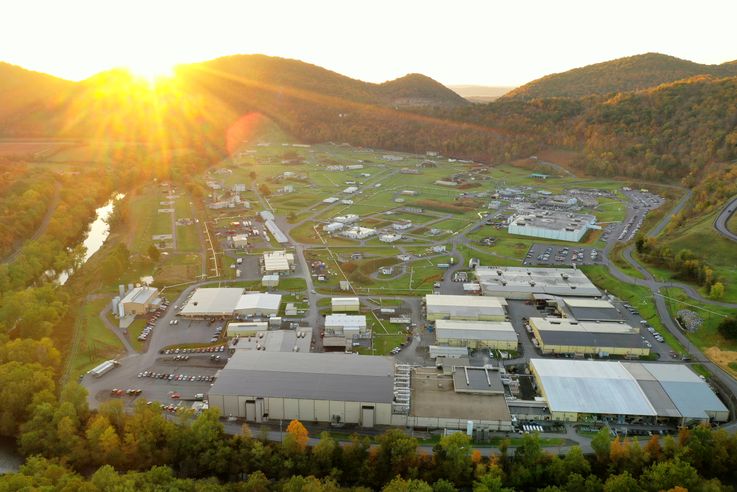

Northrop Grumman Expanding Capacity to Meet Global Security Demands